flow-through entity tax form

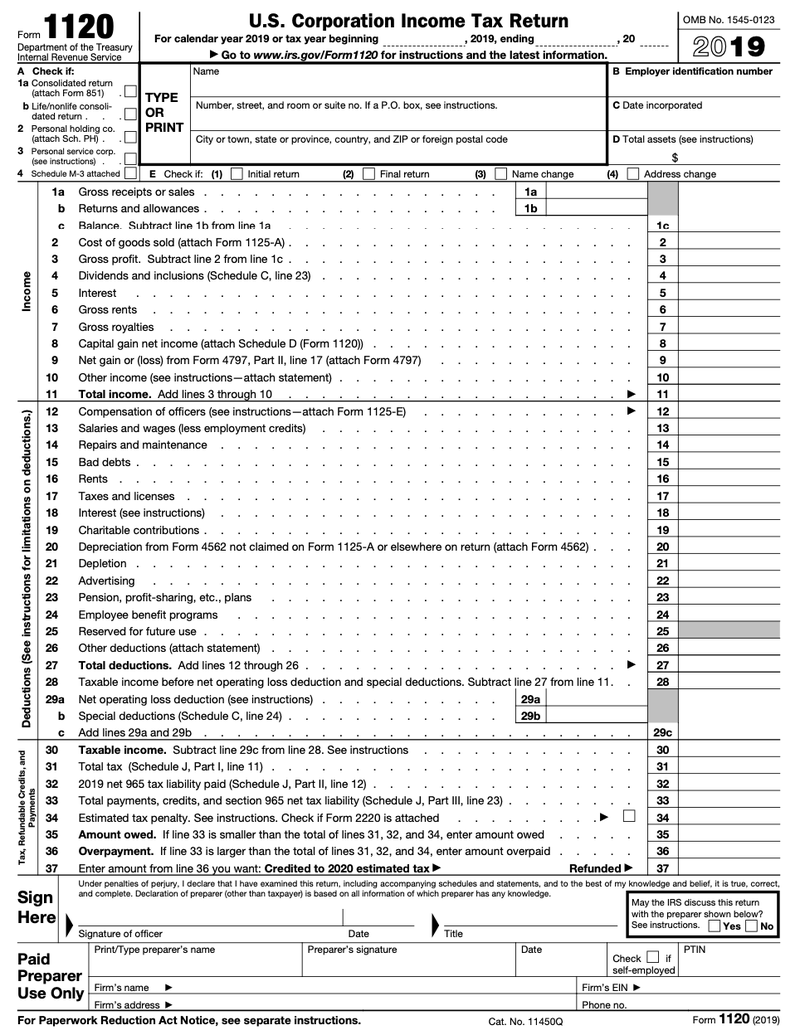

The 1120 is the C corporation income tax return and there are no flow-through items to a 1040 or 1040-SR from a C corporation return. You are required to notify Amazon of any change to your tax identity information by retaking the tax information interview if the change could invalidate your W-9 W-8 or 8233 form.

How To File Tax Form 1120 For Your Small Business The Blueprint

This form is completed by entities or persons acting as either an intermediary or flow-through entity that is accepting a payment on behalf of the beneficial owner of the income.

. Limited liability companies with members treated as a partner under Massachusetts tax law. Use caution to avoid misspellings or entering incorrect Tax Identification Numbers which can result in an invalidated tax form. See Special Instructions for Hybrid Entities later.

Change of circumstances includes. A pass-through entity is an entity whose income loss deductions and credits flow through to members for Massachusetts tax purposes. This is done on the Form 502 Pass-Through Entity Return of Income and Return of Nonresident Withholding Tax.

It must be filed by every PTE doing business in Virginia or having income from Virginia sources. Form if you are a disregarded entity or flow-through entity using this form either solely to document your chapter 4 status because you hold an account with an FFI or if you are a disregarded entity or a partnership to claim treaty benefits because you are a hybrid entity liable to tax as a resident for treaty purposes. The following are all pass-through entities.

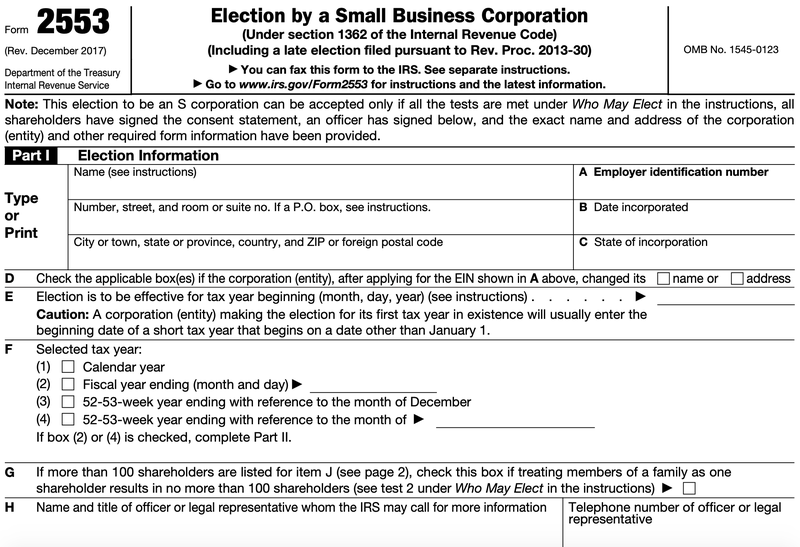

Every PTE doing business in Virginia or having income from Virginia sources is required to pay a withholding tax equal to 5 of its. LLCs can file Form 8832 Entity Classification Election. Income Tax Return for an S Corporation Instructions US.

The IRS expects non-withholding foreign trusts and non-withholding foreign partnerships to provide copies of the tax certification documentation for each grantor beneficiary or partner because the. The Form 502 is not optional. However if a qualifying LLC elected to be an S Corporation it should file a Form 1120S Form 1120S US.

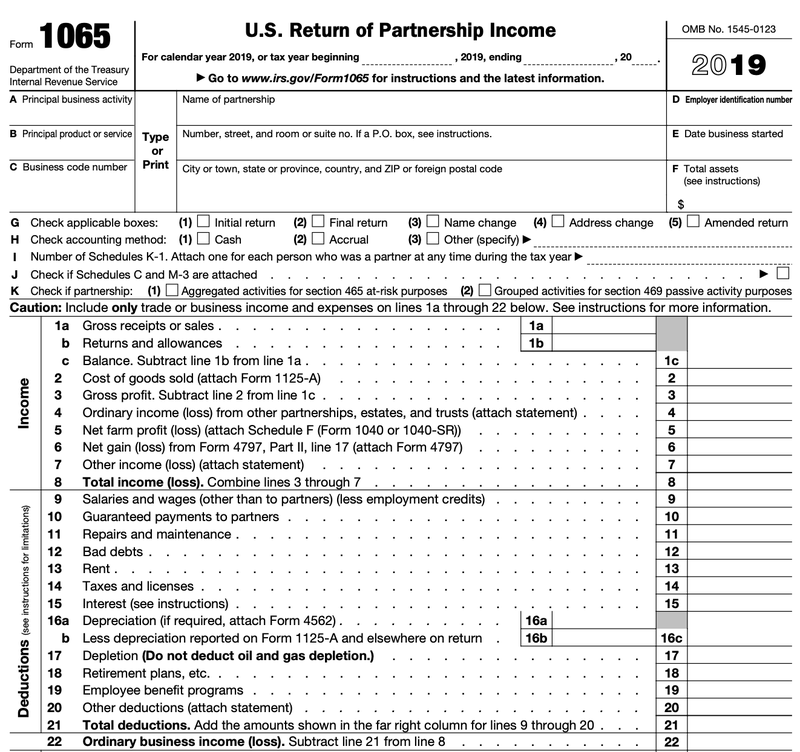

Understanding The 1065 Form Scalefactor

A Beginner S Guide To Pass Through Entities The Blueprint

Pass Through Entity Tax Treatment Legislation Sweeping Across States Bkd Llp

How To Fill Out Form 1065 Overview And Instructions Bench Accounting

Considerations For Filing Composite Tax Returns

Pass Through Taxation What Small Business Owners Need To Know

Pass Through Entity Definition Examples Advantages Disadvantages

Pass Through Entity Definition Examples Advantages Disadvantages

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at8.30.22AM-d7e4bd231b2148cea273c25d3656e946.png)

Schedule K 1 Beneficiary S Share Of Income Deductions Credits Etc Definition

/ScreenShot2021-02-09at9.53.37AM-3b9683fcfe1641f7a2a84cd4efa92474.png)

Form 1120 S U S Income Tax Return For An S Corporation Definition

What Is A Pass Through Entity Definition Meaning Example

What Is A Disregarded Entity And How Are They Taxed Ask Gusto

4 Steps To Filing Your Partnership Taxes The Blueprint

/ScreenShot2021-02-07at8.30.22AM-d7e4bd231b2148cea273c25d3656e946.png)

Schedule K 1 Beneficiary S Share Of Income Deductions Credits Etc Definition

/4797-3b4366c079144f94baf030ecdfd05ed9.jpg)

Form 4797 Sales Of Business Property Definition

How To Fill Out Form 1065 Overview And Instructions Bench Accounting

:max_bytes(150000):strip_icc()/ScreenShot2021-02-09at9.53.37AM-3b9683fcfe1641f7a2a84cd4efa92474.png)

Form 1120 S U S Income Tax Return For An S Corporation Definition